Volunteer

Let us consider how we may spur one another on toward love and good deeds.

-Hebrews 10:24

At Foundation Academy, there are many ways to share your time and talent as a parent through volunteering. Whether you’re interested in joining our parent-teacher organization PAWS, participating in our weekly Moms in Prayer Group, assisting with athletics or our fine arts league, or assisting with another area in need, we have a spot for you. Please complete a background check (good for 5 years). To volunteer click below on “Sign up to Volunteer”!

To schedule an appointment for a background check please email Mary Jean Cravey at Maryjean.Cravey@foundationacademy.net.

Volunteer Board Opportunities

*A background check is required to serve in any board role. Please contact Mary.Jean@foundationacademy.net to schedule a background check.

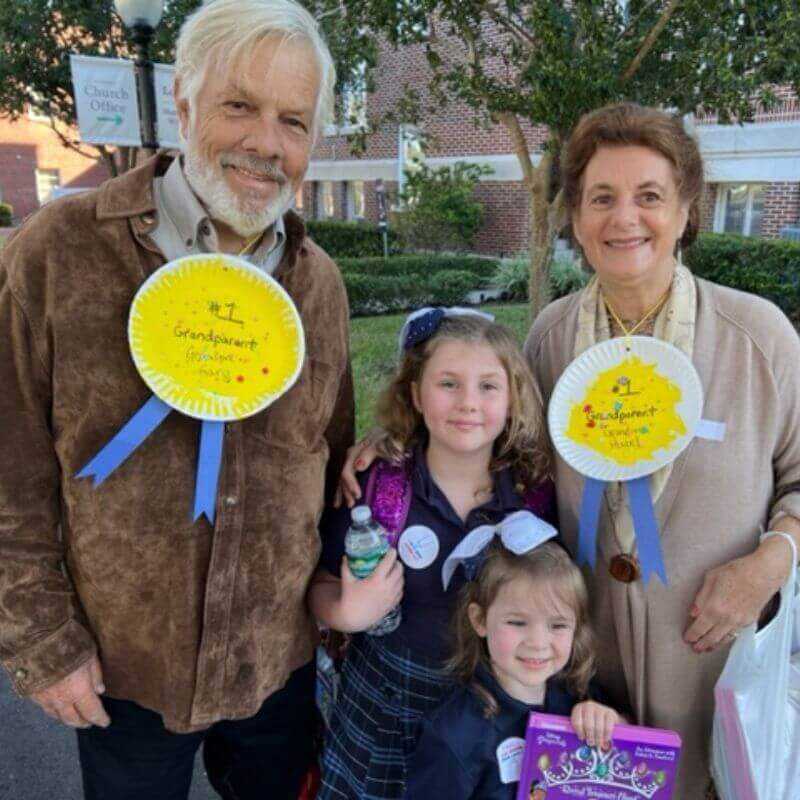

Volunteer Spotlights

Would you like to share your experiences from volunteer events?

Volunteer Spotlight Submission Form

Only complete this form if you have a testimony to share about your volunteering experience at Foundation academy. To volunteer, scroll up to the button “Sign Up to Volunteer”. Thank you.

"*" indicates required fields

Room Parent Registration Form

Deadline for applications August 16, 2023

*Parents can only apply to be a Room parent for one class. Room parents are only for PK3 – 5th Grade.

Registration to become a room parent has closed for the school year.

Sign Up For Our Newsletter The Keystone.

Stay informed about the entire “Family of Campuses”! Better yet become part of the FAmily & help shape the culture and simply be a part.

Get the last news on student successes, volunteer opportunities, college acceptances, campus expansions, and more, subscribe to The Keystone today!