Blessed by Giving

I’m Kyle Newell and I have two boys at Foundation Academy. I have spent many years wrestling with this topic and have dedicated my life’s work to helping people be wise with their money. I am owner of Newell Wealth Management and am a fee only financial advisor with an office in Winter Garden on Dillard St. I’d be happy to talk about this with you and pray with you about it as well. You can email me at kyle.newell@newellwm.com, text/call me at 407.337.7128, or set up an appointment.

Financial Chores

I need to start by confessing. I made a terrible mistake even though I was warned not to do it. What’s this dreadful mistake? I accidentally dried my wife’s sweater.

While doing laundry the other day, I got wrapped up in all the other items I was washing, drying, and folding. We were enjoying a fun date night of watching TV and folding laundry together while the kids slept upstairs. Suddenly I heard the dreaded words of disappointment.

“Kyle,” she said, “you dried my sweater.” I thought about protesting my innocence. When I turned to look at her, sure enough, it had shrunk several sizes. My wife is petite, but the sweater was shrunken so much that it’s now unusable.

Helping with the laundry was me trying to do the right thing. Unfortunately for my wife and the sweater, I got overwhelmed and made a mistake.

What I had envisioned as a way to help and share time together didn’t go as planned. Like so many other chores, doing laundry is something I dislike. The reason is that it has to be done continuously. Over and over, a load of laundry must be done every few days.

I know you’re asking yourself, “What does any of this have to do with financial chores and planning?”

With a new year upon us, here are three financial chores that may give you pause or something to think about. Just like doing laundry over and over, some things always need to be evaluated, especially as you’re saving for retirement.

Financial chores are similar to the chores in life that must be done over and over again. You may not enjoy the idea of having financial chores, but it’s important to revisit your financial plan periodically to ensure it’s still the right one. There may be some routine change you aren’t aware of or confident in. Every once in a while, you may dry a sweater, financially speaking.

Financial Chore #1:

Know the Retirement Plan contribution limits.

Retirement Plan contribution limits have changed for 2023. With inflation being historically high, the retirement planning contribution numbers have bumped up to keep up with it. If inflation is higher, you may need to save more to maintain your lifestyle down the road.

One of the things that the IRS has done is change the amount of money you can put into your retirement plans and stay within the limits. Most Disney cast members, leaders, and employees use the Disney 401k benefit. For those under 50, the new maximum you can put into the 401k is $22,500 for 2023. If you are over 50, you can do what’s called a “catch-up provision,” which is $7,500.

Disney’s contributions don’t give you a dollar amount. They are done by a percentage. To get the percentage, you’ll take your $22,500 if you’re going to max out under 50 or $30,000 total if you’re going to max out over 50 to get the percentage.

Example

For easy numbers, let’s say your income is $100,000. You want to put in $22,000. That is 22% of your income that needs to go into the 401k.

When you make that change, you need to account for the time that you make the change. If you are making the change today, there has already been one week of contributions that have gone in because Disney pays every Thursday.

Try to account for that and bump it up a little bit or stay at the 22% and be okay with it. Try to have the percentage equal to max out over the course of the entire year. You don’t want to max out too early because it may cause you to miss out on some company contributions.

If you’re contributing to IRAs or individual retirement accounts, those limits have also bumped up. Whether a traditional IRA, Roth IRA, or a backdoor Roth IRA transaction, those numbers have bumped up for those under 50 to $6,500 with a $1000 catch-up for those over 50. Just be cognizant of those numbers as you make your contributions for the year.

Financial Chore #2:

Consider your withholding amounts.

Because of inflation, tax brackets have adjusted this year as well. They have increased somewhat, so you may need to adjust the withholding on your income if you currently work at Disney. The amount of your withholding may need to be reevaluated.

If you’re retired from Disney, looking at your pension, Social Security, retirement withdrawals, etc., may be necessary. You may want to withhold a different amount based on what you think your income will be with the new tax brackets, numbers, and how you file your taxes (single, married, joint, etc.)

Run the calculations for:

- What your expected income for the year will be

- What amount of tax will you owe

Adjust the withholding amount accordingly, so you don’t have too much or too little. Too much withholding gives the government a tax-free loan by overpaying. Too little will have you owing money that will have to be paid back when you file your taxes next year.

Financial Chore #3:

Evaluate your investment strategy.

Like doing laundry, you must regularly revisit and reevaluate your investment strategy. You may find that you don’t need to make a change. Maybe you should. You won’t know unless you understand your goals and plans.

- Where are you at

- What are you trying to accomplish

- What has the economy given us

- What has the world given us

- Are you closer to your goals

- Do you need the money sooner

The answers will then trigger whether you need to change your investment strategy or not. You may also want to change some of the individual holdings. You may want to stay invested in stocks, but one international investment fund may be doing better than another, and so on.

With stocks down so much last year, it may present an opportunity to buy more. If you need the money sooner, you may need to change that strategy to have access to the funds.

These basic financial chores, when done regularly, can keep your finances in a healthy place. I may not be great at doing the regular laundry, but if you have questions about your financial chores, I’m happy to help.

We can meet virtually or in person if you live in the Central Florida area. Please email me at kyle.newell@newellwm.com, call/text at 407.337.7128, or schedule a meeting at Schedule – Newell Wealth Management (newellwm.com)

Calendar and Checkbook

Have you ever heard a sermon that changed your life? What about a simple sentence? I have. As I was getting started in my career in financial services, our pastor at the time, said (and I’m paraphrasing), “There are two things that tell you what your priorities are, your calendar and your checkbook.” This stuck with me to the core and has been something I think about often. Of course, we don’t use checkbooks anymore, but you still get the point. Our time and money are tangible outworkings of what we genuinely care about.

Treasures Today

Jesus said, “for where your treasure is, there your heart will also be” in Matthew 6:21. Money decisions do not lie. A modern-day saying related to this is “follow the money.”

I asked a woman once what her priorities were. She listed her family, having her house be home, traveling, and of course, her faith. When we looked at her expenses over the past several months, the highest single cost besides her mortgage was food -eating out in particular. This was eye-opening to her. There was a disconnect between what she thought were her priorities and where her dollars were going. Sometimes, this is just an oversight or ignorance even. Sometimes, something more is happening. Regardless, knowing where your treasure is, helps to open your eyes to your priorities.

Practical Tips:

Set an appointment with your spouse to discuss what your priorities are. Some examples are, advancing the Gospel, family vacations, health, education, meeting the needs of others, and of course, the necessities of living.

Assign one of you to research where expenses have gone over the past 3-6 months. You can use a tool like mint.com.

Meet again to review results and see how things align with what you’d like to do.

I’m Kyle Newell, and I have two boys at Foundation Academy. I have spent many years wrestling with this topic and have dedicated my life’s work to helping people be wise with their money. I am the owner of Newell Wealth Management and am a fee-only financial advisor with an office in Winter Garden on Dillard St.

I’d be happy to talk about this with you and pray with you about it as well. You can email me at kyle.newell@newellwm.com, text/call me at 407.337.7128, or set up an appointment.

Important Information

Newell Wealth Management, LLC (“NWM”) is a registered investment advisor offering advisory services in the State of FL and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by NWM in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only and is not intended to provide specific advice or recommendations for any individual. Opinions expressed herein are solely those of NWM, unless otherwise specifically cited. Kyle Newell and NWM are neither an attorney nor an accountant, and no portion of this website content should be interpreted as legal, accounting, or tax advice. Material presented is believed to be from reliable sources, and no representations are made by our firm as to other parties’ informational accuracy or completeness. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investment involves risks including possible loss of principal and, unless otherwise stated, are not guaranteed. Any economic forecasts set forth may not develop as predicted and are subject to change. All information or ideas provided should be discussed in detail with an advisor, accountant, or legal counsel prior to implementation.

How Much is Enough?

We got chinch bugs the other day – yikes! They destroyed some of our grass before I figured out what the problem was (I have been a DIY yard guy for the past few years – I know, I know, I need to hire someone – it’s on the list, okay). Anyways, I needed to get some sod to replace the destroyed spots in my yard. So, I used my foot (literally) to measure the area, and I used my head to add up how much sod I needed. I drove to the local hardware store, which had no sod. Then I drove to the big box hardware store, and they didn’t have any either! I learned and called before returning to the store the next time. A few days later, the big box store had some sod in stock. I drove there and got what I needed. When I got home, I laid the sod out, and you know what? It wasn’t enough! I was instantly reminded of my dad’s frequent admonitions to measure twice.

Measure Twice

How much is enough is a question not only for my DIY project but it is a question top of mind for many when it comes to their finances.

Jesus said, “For which of you, wanting to build a tower, doesn’t first sit down and calculate the cost to see if he has enough to complete it? Otherwise, after he has laid the foundation and cannot finish it, all the onlookers will begin to ridicule him, saying, ‘This man started to build and wasn’t able to finish.’ –” Luke 14:28-30 (CSB)

The challenge is, when building a house, we know what complete looks like. When it comes to money, the picture is not always so clear.

As such, we tend to go a few different ways.

One may say, I need to be prepared, so they save and save and save. Using the house analogy, building a “roof” that covers them no matter where they go. Jesus tells a story of a man who did this then God called him a fool and demanded his life the night he completed that work (paraphrasing Luke 12: 16-20).

Another might say it’s too complicated or I can’t worry about building the house, who knows what will happen, so I’ll enjoy my time now. Jesus tells the parable of the talents as a warning of squandering the gifts God has given (paraphrase of Matthew 25: 14-30).

So what should I do?

In that same story of the talents (Matthew 25: 14-30), one of the servants is commended for being faithful and is told well done!

The call to being a faithful steward of the resources our master has given us is clear.

Therefore, we must put in the effort to hear “well done.”

Practical tips and questions

Pray for God’s guidance on your current expenses, savings, investments, and future.

Ask yourself, where are you building treasures?

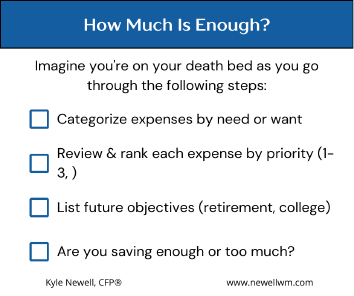

Here is a guide to think through how much is enough:

Giving strategies to consider if there is excess

Donate appreciated stocks, mutual funds, and even property: You can give investments typically to a charity, nonprofit, church, school, etc., without having to sell it first. You give the organization the investment, you get the deduction for the market value at the time of the gift, and you do not have realized capital gains taxes to pay.

Donate your required minimum distribution (RMD) if you’re over 70.5. You can give your RMD from your IRA (401k and other employer plans do not qualify) to a charity, nonprofit, church, school etc. and avoid the income tax completely on that (up to $100,000). It’s called a qualified charitable distribution. Even the the RMD now starts at 72, congress allows you to give from your IRA starting at 70.5.

Treasures in heaven and abundant life

Once you have figured out how much is enough, it allows you to fully pursue those treasures in heaven and feel that abundant life Christ calls us to. Not worrying about whether you have enough or getting more just in case. Rather, look at the gifts God has given you and how best to use them for His glory.

I’m Kyle Newell, and I have two boys at Foundation Academy. I have spent many years wrestling with this topic and have dedicated my life’s work to helping people be wise with their money. I am owner of Newell Wealth Management and am a fee only financial advisor with an office in Winter Garden on Dillard St.

I’d be happy to talk about this with you and pray with you about it as well. You can email me at kyle.newell@newellwm.com, text/call me at 407.337.7128, or set up an appointment.

Important information

Newell Wealth Management, LLC (“NWM”) is a registered investment advisor offering advisory services in the State of FL and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by NWM in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only and is not intended to provide specific advice or recommendations for any individual. Opinions expressed herein are solely those of NWM, unless otherwise specifically cited. Kyle Newell and NWM are neither an attorney nor an accountant, and no portion of this website content should be interpreted as legal, accounting or tax advice. Material presented is believed to be from reliable sources, and no representations are made by our firm as to other parties’ informational accuracy or completeness. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investment involves risks including possible loss of principal and, unless otherwise stated, are not guaranteed. Any economic forecasts set forth may not develop as predicted and are subject to change. All information or ideas provided should be discussed in detail with an advisor, accountant, or legal counsel before implementation.

Has your spouse ever asked you to do something, and you had no clue what he or she was talking about? Here is a quick story of one of those times.

“Hey honey, could you go and unscrew that?” Brooke said from the kitchen, pointing in my general direction as I came out of our bedroom. I stopped momentarily and tried to think about what she was asking me to do. Had we just had a conversation, and I completely blanked? Had I forgotten to do something I said I would do (something I do too many times)? So, at the risk of getting the dinner she was preparing thrown at me, I asked, “unscrew what?” In a flustered tone, she repeated, “Go unscrew that,” and motioned behind me. Still rather confused, I asked one more time, “Would you describe exactly what you want me to unscrew?” She laughed and said, “The hose outside on the trampoline.” At that moment, I remembered we had spoken about that earlier, but in that moment it had completely escaped me. We have something like this come up more often than we probably should, and Brooke is a good sport for letting me share that story.

Did you know that the Bible talks about money/possessions twice as many times as faith and prayer combined? Thankfully, God is very clear in his instructions to us, especially regarding money.

While that is over 2,300 verses, here are a few that come to mind that provides great clarity on what the Christians’ perspective should be when it comes to money:

- Luke 9:23: Then he said to them all, “If anyone wants to follow after me, let him deny himself, take up his cross daily, and follow me.”

- Christ calls us to deny ourselves and follow Him

- Matthew 6: 21: “For where your treasure is, there your heart will be also.”

- Christ challenges what our hearts long for

- Jesus tells several stories about how money/possessions are handled:

- Zacchaeus gives half his possessions to the poor after meeting Jesus – Luke 19:1-10

- The rich young ruler walked away from Jesus after Jesus asked him to give all he had to the poor – Mark 10:17-27

- The widow who gave her two coins is praised by Jesus – Mark 12: 41-44

- The parable of talents about being a good steward with what has been given from God – Matthew 25:14-30

So what is the point?

God cares deeply about how we handle money because it is an outworking of what we truly believe. I’m not trying to tell you to sell everything and give to the poor; I don’t think God wants that for everyone. For some, he might, but not everyone. Rather, evaluate your relationship with money in light of the faith you claim to believe.

Practical Application / Questions:

- If you look at your expenses the past several months (mint.com is a source to be able to easily track and manage this), where would you say your treasure lies?

- Decide to put money towards treasures in heaven

- Pray to God for help and forgiveness